The Market Storm Has Subsided, But What Lies Ahead Is Whole Lot of Uncertainty

Cryptocurrency markets have seemingly reversed the downward trend in value and have started to gain steam again. At the moment bitcoin core markets are hovering around $12,650-12,950 for the three hours. Volume is decent for a Saturday, as BTC markets are seeing roughly $11.6Bn in global trade volume while bitcoin core, ethereum, and tether are hold the highest trade volumes today. The top exchanges swapping the most BTC this weekend include Upbit, Bitfinex, Okex, Bithumb, and Binance. The South Korean exchange Upbit has been trading some notable volumes over the past few weeks and has become one of the largest exchanges worldwide.

Cryptocurrency markets have seemingly reversed the downward trend in value and have started to gain steam again. At the moment bitcoin core markets are hovering around $12,650-12,950 for the three hours. Volume is decent for a Saturday, as BTC markets are seeing roughly $11.6Bn in global trade volume while bitcoin core, ethereum, and tether are hold the highest trade volumes today. The top exchanges swapping the most BTC this weekend include Upbit, Bitfinex, Okex, Bithumb, and Binance. The South Korean exchange Upbit has been trading some notable volumes over the past few weeks and has become one of the largest exchanges worldwide.

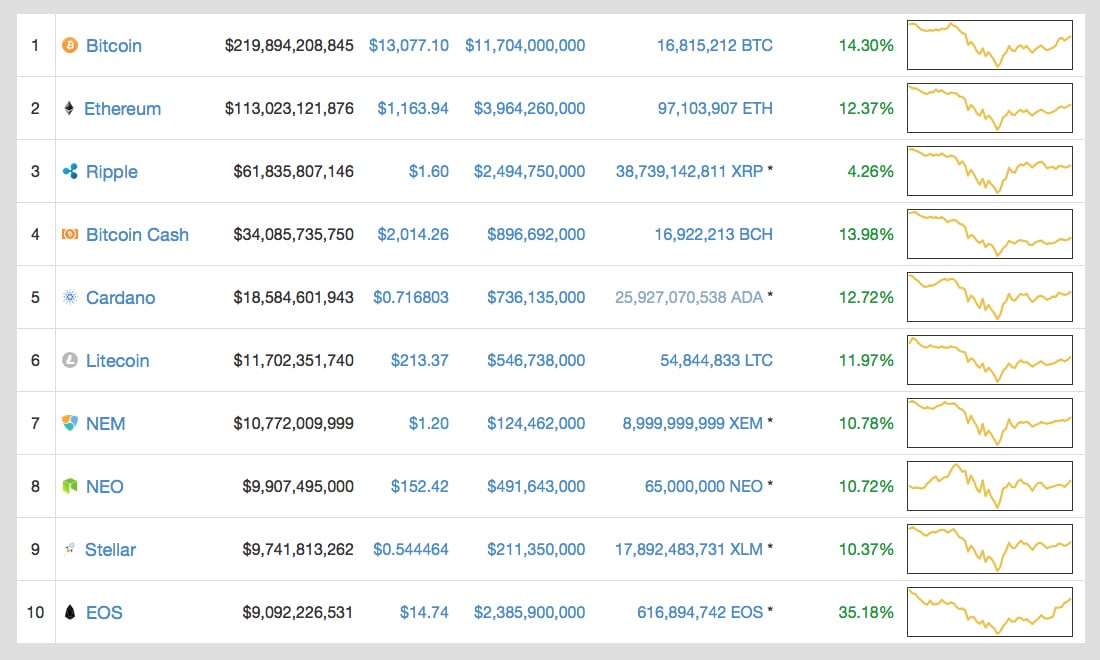

Over the past few weeks, the U.S. dollar has been the top nation state issued currency traded with BTC. However this week Japan has taken the lead once again, as the yen now captures 36 percent of the global trade volume. This is followed by the USD (32%), tether (USDT 12.8%), the Korean won (7.5%), and the euro (4.9%). The most popular traded cryptocurrency paired with BTC on Shapeshift is still ethereum. The overall market capitalization of all 1,469 digital assets is $635Bn, and bitcoin core markets dominate by 34 percent at the time of writing.

Technical Indicators

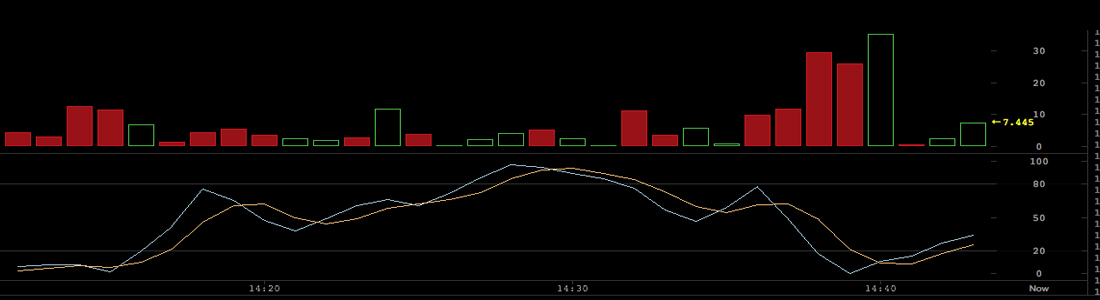

Looking at the charts things are a bit more bullish than a few days prior. Volume is definitely not as strong but buyers are controlling the market, and BTC/USD market values continue to rise. At the moment there is deep resistance right now at the $13,000-13,150 zone but bulls have been slowly chipping away at those orders. It’s safe to say that BTC is struggling to break past crucial resistance levels which could lead to a sell-off point if things cannot hold.

Currently, the two Simple Moving Averages (SMA) have changed courses since our last markets update. The short-term 100 SMA is still below the longer term 200 SMA which indicates the path to resistance will likely head southbound. However, both RSI and Stochastic oscillators are headed northbound showing more room for price improvements, but there’s also room to drop as well. At present order books show thicker sell walls above the $13,500 territory alongside even more in the $14K regions. On the backside, there is excellent support at the $12,200 through $11,900 zones, but after that, the books start to thin out. A lot of traders believe the storm is not over and expected a ‘dead cat bounce’ at $13K. These negative speculators think bitcoin could range between $9,000 to even $5,000 in the short term. More optimistic traders believe the storm is over and we should be heading towards the $16K zone over the next week while also reaching all new highs next month.

Cryptocurrency Markets In General

As mentioned above most cryptocurrency markets are doing very well, and only tether is suffering today because many traders have exited that strategy so they can plot new positions. The second highest market cap is still held by ethereum (ETH) as the market value is up 12 percent. One ETH is averaging $1,163 per token, and the market is the second most traded cryptocurrency today. The third position is held by ripple (XRP) as its markets are up 4 percent and each XRP is priced at $1.60. Bitcoin cash BCH markets are up by 13.9 percent, and the currency is seeing over $800Mn in global trade volume presently. One BCH has an average price of around 2,014 per coin, and the market has a valuation of around $34Bn. Lastly, the fifth highest market cap is still controlled by Cardano (ADA) as markets are up 12 percent and each token is priced at $0.71 per ADA.

Again many traders are uncertain of the short-term future that lies ahead as far as government crackdowns and reaching all-time highs. Many agree that so far bear market sentiment may not be over yet and newer lows could happen. If the price can breach past $14-15K rigorously, then the trend reversal could have more of a solid foundation. Bulls are maintaining some momentum at the moment, and the next 24-hours may show some clearer signs.

Comments

Post a Comment