If you’ve been into cryptocurrencies long enough, you’d know that the price of bitcoin changes very often. There are plenty of bitcoiners who buy the dips and sell the tops, but those plays can have potential risks that people just holding their assets don’t have to face. Now, these types of investors are purchasing small amounts of bitcoin and using a strategy called dollar cost averaging.

Day Trading Bitcoin and Intra-Range Strategies Can Be Risky

Many people know that if you have bitcoins, you can sell them when you think the market has reached resistance or a high that will be followed by a significant dip. It’s at these times you can make some good money flipping bitcoins. For instance, if you purchase BTC at a low entry point and the price gains by 20 percent and you sell the BTC at that high then there’s potential to gain more bitcoins, if it drops back down to any number below the top sale. You can do it just a few times a month, or you can make a career out of trading cryptocurrencies. However, this type of trading technique comes with many risks that can leave traders high and dry. One risk that’s tethered to this kind of exchange is leaving funds on a trading platform that could cease operations in a blink of an eye. Lastly, bitcoin prices don’t follow most people’s predictions, and you may miss the highs and lows and lose significant amounts of funds forecasting the wrong market events.

Dollar-Cost Averaging: The Hodler’s Choice

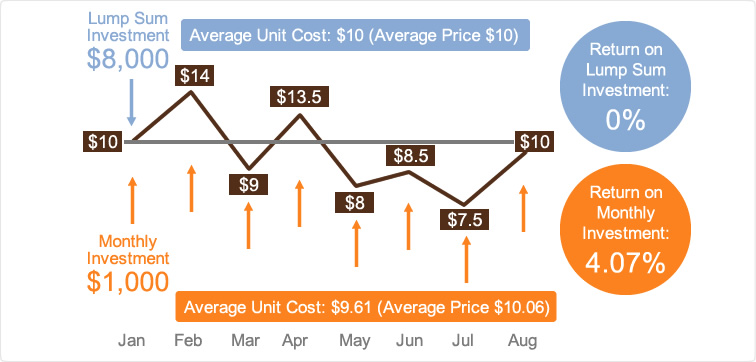

Investors that are hedging bitcoin like hoarders or ‘hodlers’ for much longer term gains use a strategy called ‘Dollar-Cost Averaging’ (DCA). This technique is used by those who believe in the long-term progress of bitcoin and other digital assets. Using the DCA method means purchasing a fixed dollar amount of bitcoins no matter what the price happens to be. Further, the DCA technique requires purchasing the fixed dollar price using a scheduled calendar as well.

The ‘Hodler’s approach’ is far less stressful than those who day trade or play intra-range strategies. Those who purchase bitcoin or other cryptocurrencies using the DCA technique don’t have to watch the charts all the time or set price alarms so they can catch rises and dips. DCA investors are investing in the digital asset for the long haul, and everyday price volatility is meaningless to the hodler to a degree. Another aspect of buying a fixed dollar amount using a schedule means the investor doesn’t have to transfer funds to an exchange or keep funds there for faster trades. DCA investors can hoard their savings using cold storage and only send when they are ready to sell.

Recurring Purchases

There are a few companies like Coinbase and Blockchain.info, that offer recurring purchases. This means the platform will let you set a desired amount of bitcoin you want to purchase on a set schedule. The service will then deduct funds from your bank account or card listed, and you can acquire bitcoins using the DCA method in a more automated fashion.

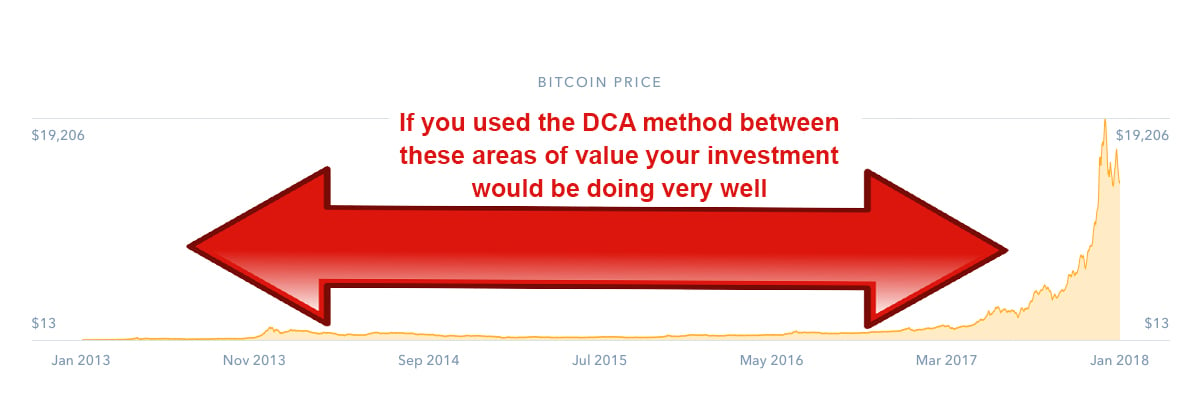

Holding Cryptocurrencies for a Long Time Seems to Be Paying Off

Dollar-cost averaging isn’t for everyone, and some people believe buying dips and selling at tops is a far more profitable means of investing. However, most people would agree that DCA is a safer method of investing because it’s less stressful and you don’t have to keep money on an exchange or pay lots of fees to send money to trading platforms.

Basically by using the DCA method users can get an average cost of their overall investment over time. With the way things have been going with cryptocurrencies over the long term just holding digital assets has been a profitable means of investing.

Comments

Post a Comment